Introduction to Oil and Energy in Libya

Team Leader: Michael Brown

Analysts: Hannah Barltrop, Nicholas Boyce, Jessie Dhillon, Alli McDonald,

Kavisha Patel, Ashmeet Siali, Luca Tersigini, Alycia Wettlaufer

The Economy

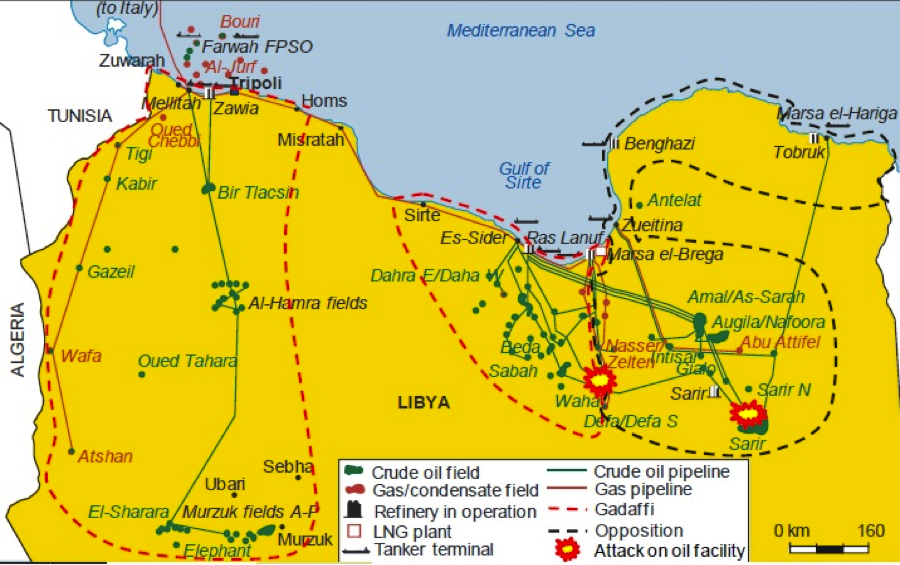

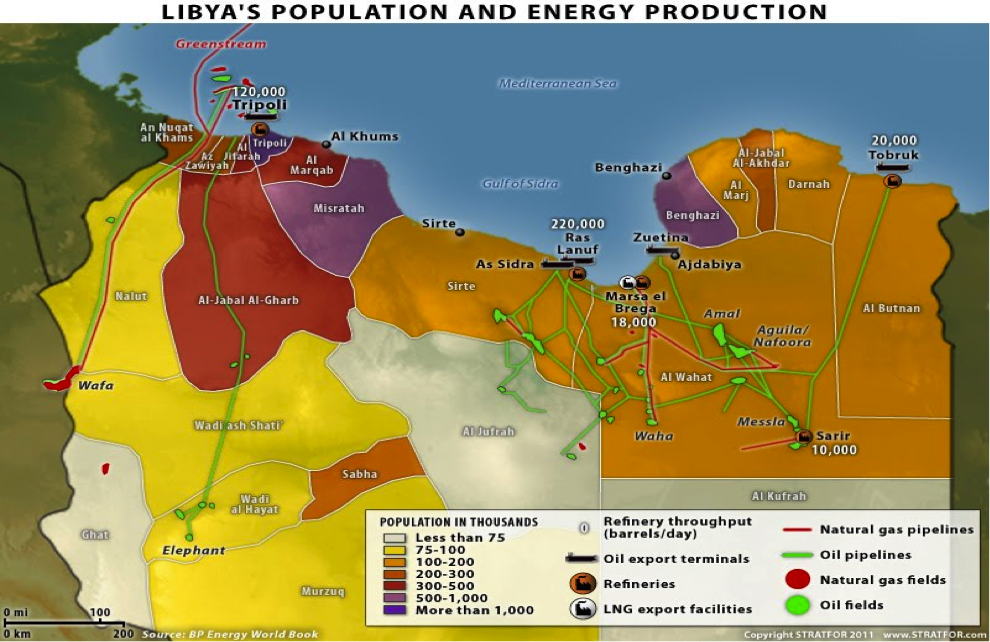

The Libyan economy is and has been heavily reliant on oil and gas exports. However, the economy has been plummeting since early 2015 as the country became torn apart by a civil war. This war ultimately caused world oil prices to drop and the Libyan economy stagnated. The 2015 conflict also resulted in a fight between rival groups to capture the country’s largest oil terminal. This ended up creating tremendous decreases in oil production that also severely undermined the economy. Further, the government of Libya continued to pay the majority of the Libyan workforce government salaries. This created the outcome of a 49% deficit in the country’s GDP.

To look at things on a wider scale, the politicians that have been in power in Libya have neglected to investment in the country’s infrastructure, which inevitably creates struggle. Finally, ISIL has a strong foothold on many of Libya’s oil fields. This leaves Libya unable to profit from the oil and unable to strengthen the already shattering economy. Because the country is losing money through political corruption, civil war, rivalry and even ISIS, they are unable to invest in the energy sector for their country. The consequences of this are widespread power outages in Libya. Speaking on a global level, the energy sector in Libya is deteriorating because of the same aforementioned reasons. The oil and gas produced has shrunk to very low amounts and is causing frenzy among the rest of the oil dependant. This is concerning as oil and gas represent approximately 95% of the nations exports.

Decline in Finances

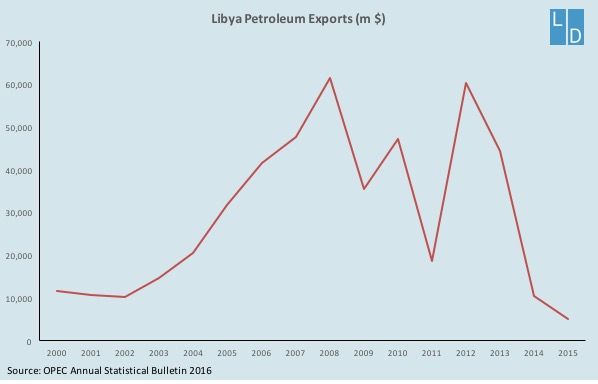

The energy sector plays a large role in the Libyan economy and its finances. The cost of the political conflict in Libya has taken a severe toll on the Libyan economy, which has remained in recession from 2013 to 2015.[1] Libya’s total budget revenue indicates decreasing revenue and an increased deficit.[2]Outside of the oil industry, foreign investment in Libya is limited. [3] Foreign investment is not allowed in certain areas, including banking, insurance, domestic commerce, and foreign aid.[4] The Libyan banking system is collapsing due to the lack of liquidity and corruption.[5] As a result, Libya went from being balanced in 2013 to a massive deficit in 2015.[6] To finance this deficit, net foreign reserves are being rapidly depleted.[7]

Before Libya’s revolution in 2010, the country exported 1.6 million barrels of oil per day; by late 2014, oil production in the country had fallen below 300000 barrels, a 65% drop.[8] In August 2016, Libya reported exporting only 200000 barrels per day.[9]The Libyan revolution caused damage to oil infrastructure, and blocked oil production and exports, constraining the economy.[10] Oil is the key driver of Libya’s economy. The economy depends primarily on the oil sector, which represents over 95 percent of export earnings.[11] Moreover, the oil and gas sector account for about 60 percent of total GDP. [12]Oil prices have declined 45 percent.[13] Oil companies are experiencing pressure on their revenues and profits due to the decline in oil prices. [14] The Libyan energy sector needs higher prices in order to stabilize. The Libyan currency, known as the Dinar, reflects an increase in stability. [15] In the past year, the historical data indicates a spike in value, and in the future it projects to increase on an upward trend.[16] Gross Domestic Product (GDP) growth is predicted to increase in 2016 and 2017.[17] In 2015 real GDP reported -10.2% but projects to increase to 22.2% in 2016 and respectively 46.2% in 2017.[18] Libya is dysfunctional but has the capacity to increase production by removing political control over production.

Historical Political Background

Muammar Gaddafi took power over Libya in 1977. He was in power until the National Transitional Council (NTC) ousted his government in 2011. Gadaffi was killed shortly thereafter. The NTC declared Libya liberated after taking power.[19] In August 2012, the NTC elected the General National Congress, to which they transferred power. Since 2014, Libya has been in a state of civil war as the internationally recognized Council of Deputies vies for power with the General National Congress, an Islamist government.[20] In December 2015, these factions merged to create the Government of National Accord (GNA), led by Prime Minister Designate Fayez al-Sarraj and with the Support of the United Nations (UN). In August of 2016, the House of Representatives, based in the city of Tobruk, rejected the GNA with a vote of no confidence.[21]

Current Political Situation

The current political situation in Libya is, at best, unstable. Since the violent end of the Muammar Gaddafi regime in 2011, the country has been it the process of rebuilding and attempting to establish a functioning and accepted government. The role of religion has played an important role in this process as well as in the formation of new governments and political parties. Islam, being the official religion of the state, is present in almost all political parties as well as the major militia and terror groups with the country[22]. These ideals and religious based moral code carry through to policy formation and the judicial system, especially in regards to the formation and enforcement of laws.

There has been a revolving door government ever since the death of Gaddafi, with the United Nations currently backing a “unity” government[23]. This “official” government faces challenges from two other groups who also claim to be the “official” government - the National Salvation and the Government of National Accord - while also fighting against militia and terrorist groups - such as the Islamic State(ISIL) - who are also seeking to have control and power over Libya[24]. Due to this, very little is actually being done by any of the three governments and therefore establishing any form of domestic or foreign policy is near impossible. The only thing that can be said is that all three governments rely heavily on Sharia Law and Islamic beliefs to justify their actions.[25]

On the international stage, Libya has been a highly debated topic, and has become a centre of violence and controversy. There is a long-standing history of violence between Libya and the United States and its allies, as well as a near constant state of civil war within the country itself since 2011[26]. NATO and US airstrikes were common during the Western intervention in 2011 and since then the United States has continued to periodically launch airstrikes against the country[27]. The role of Libyan nationals in terrorist attacks, most notably the bombing of a PanAm passenger plane in 1988 and the Benghazi Embassy attack in 2012, has further deteriorated relationships between Libya and the Western world.[28] Relationships have been somewhat repaired since then, especially with the recent international deals regarding the export of Libyan oil, and the involvement of the United Nations as body in attempt to restore a single government within the nation[29]. Current relations between Libya and the world are built primarily on the exporting of Libyan oil and other resources as well as stopping the spread and control of ISIS. This has become an especially prevalent issue in the past month, as militias have seized oil terminals as an attempt to challenge the United Nations backed government[30]. Overall, international roles in Libya have shifted from ending the Gaddafi regime to stopping the current civil war and the militia and terrorist groups within the country, with the end goal being to restore some form of government while providing humanitarian relief to the Libyan people and protecting the massive oil supply within the country.

Key Players and Investors in the Libyan Energy Sector

The civil war in Libya has had devastating consequences on the energy sector within the country. Outsider parties, mainly militias, have attacked oil and gas facilities with labor strikes and take-overs.[31] As a result, both the foreign and local investors involved in Libya’s energy sector have been affected.

Following the political conflict in July 2014, Libya’s rival parliaments fought to control key institutions, including the National Oil Corporation (NOC), chaired by Eng Mustafa Sanalia. The NOC is a leading influence over Libya’s oil industry and accounts for the majority of the country’s output of oil.[32] The Libyan economy is highly dependent on hydrocarbons and thus, those who control the oil sector within Libya have a mass amount of power.[33] The NOC assumes the responsibility of oil sector operations within Libya, exploits and develops oil reserves, and supports the national economy through these functions.[34] The National Oil Corporation is the most important local investor in Libya’s energy sector, controlling about 70% of its oil production.

There are several important players in the foreign investor realm of Libya’s energy sector. The most prominent and important foreign investor is an Italian multinational oil and gas company called Eni.[35] In 2012, Eni announced that the Italian company had planned to invest 8 billion dollars in Libya’s oil sector over the next 10 years to further strengthen its grip on Libya as the leading foreign oil and gas producer within the country.[36] Eni has stayed an adamant player in Libya’s oil sector, and has played an active role in convincing other foreign oil companies to return to operations in Libya. Furthermore, alongside Eni, the Spanish global energy company, Repsol S.A., also have not marked down their investments in Libya yet.[37]

Many of Libya’s foreign investors have halted activity in Libya since the civil war began.[38] This is especially prevalent within the energy sector. For example, the Dutch-British oil company, Shell, used to be a forerunner in the foreign investor body of Libya. But, Shell halted activities following the 2011 overthrow of Prime Minister Gaddafi and the civil war uprising.[39] Many foreign oil companies felt the negative effects of the newly decentralized government in Libya due to the civil war and ultimately left operations in Libya as a result. Along with Shell, British Petroleum and the French multinational oil and gas company known as Total S.A. cancelled millions of dollars in investments in Libya’s energy sector in 2015.[40]

Libya also has the potential to be an excellent state for renewable energy production. Libya is situated in an optimal position for both solar and wind energy.[41] A key local investor in Libya’s renewable energy sector is the Renewable Energy Authority of Libya (REAOL), which aims to increase Libya’s renewable energy capacity.[42] Potential foreign and local investors could be enticed to invest in Libya’s energy sector if a renewable energy industry were to develop.

[5] https://www.brookings.edu/blog/order-from-chaos/2016/10/07/making-libyas-economy-work-again/

[6] https://www.brookings.edu/blog/order-from-chaos/2016/10/07/making-libyas-economy-work-again/

[7] https://www.brookings.edu/blog/order-from-chaos/2016/10/07/making-libyas-economy-work-again/

[8] http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Energy-and-Resources/gx-er-oil-and-gas-reality-check-2015.pdf

[9] http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Energy-and-Resources/gx-er-oil-and-gas-reality-check-2015.pdf

[10] http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Energy-and-Resources/gx-er-oil-and-gas-reality-check-2015.pdf

[11] https://www.brookings.edu/blog/order-from-chaos/2016/10/07/making-libyas-economy-work-again

[15] http://www.tradingeconomics.com/libya/currency

[16] http://www.tradingeconomics.com/libya/currency

[17] http://www.tradingeconomics.com/libya/currency

[19] http://www.bbc.com/news/world-africa-13754897

[20] http://www.bbc.com/news/world-africa-13754897

[21] http://www.aljazeera.com/news/2016/08/libya-backed-government-confidence-vote-160822150247789.html

[22] BBC News. Libya Country Profile. 10 August 2016. Web. 9 October 2016.

[23] BBC News. Libya Profile – Timeline. 10 August 2016. Web. 9 October 2016.

[24] Richard Hall (2016, March 31). Libya Now Has Three Governments, None of Which Can Actually Govern. Public Radio International. Retrieved from: http://www.pri.org/stories/2016-03-31/libya-now-has-three-governments-none-which-can-actually-govern

[25] Jenny Stanton (2015, July 15). How ISIS Sells Sharia Law in Libya. Daily Mail UK. Retrieved from: http://www.dailymail.co.uk/news/article-3162327/How-ISIS-sells-Sharia-law-Libya-Terror-group-erects-billboards-ordering-women-wear-baggy-heavy-hijab-covers-completely-not-wear-perfume.html

[26] Declan Walsh, Ben Hubbard, and Eric Schmitt (2016, February 19). U.S. Bombing in Libya Reveals Limits of Strategy Against ISIS. New York Times. Retrieved from: http://www.nytimes.com/2016/02/20/world/middleeast/us-airstrike-isis-libya.html?action=click&contentCollection=Africa&module=RelatedCoverage®ion=EndOfArticle&pgtype=article

[27] Stephen Castle (2016, September 14). British Lawmakers Condemn 2011 Intervention in Libya. New York Times. Retrieved from: http://www.nytimes.com/2016/09/15/world/europe/britain-libya-intervention.html?rref=collection%2Ftimestopic%2FLibya&action=click&contentCollection=world®ion=stream&module=stream_unit&version=latest&contentPlacement=7&pgtype=collection

[28] BBC News. Libya Profile – Timeline. 10 August 2016. Web. 9 October 2016.

[29] United Nations. Libya Must Have Function Government to End “Tragic” Humanitarian Situation, Security Council Told. 6 June 2016. Web. 9 October 2016.

[30] Suliman Alizway and Declan Walsh (2016, September 11). Militia Seizes Libyan Oil Terminals in Challenge to Government. New York Times. Retrieved from: http://www.nytimes.com/2016/09/12/world/middleeast/militia-seizes-libyan-oil-terminals-in-challenge-to-government.html?rref=collection%2Ftimestopic%2FLibya

[31]Christopher Chivvis and Jeffrey Martini, Libya After Qaddafi, report no. 978-0-8330-8489-7 (Santa Monica, CA: RAND Corporation, 2014), accessed October 09, 2016, http://www.rand.org/content/dam/rand/pubs/research_reports/RR500/RR577/RAND_RR577.pdf.

[32] Noc, "About Us," National Oil Corporation, accessed October 08, 2016, http://noc.ly/index.php/en/about-us-2.

[33] Richard Bridle, Lucy Kitson, and Peter Wooders,Fossil-Fuel Subsidies: A Barrier to Renewable Energy in Five Middle East and North African Countries, report (Winnipeg, MB: International Institute for Sustainable Development, 2014).

[34] Noc, "About Us," National Oil Corporation, accessed October 08, 2016, http://noc.ly/index.php/en/about-us-2.

[35] Issa Ali and Charles Harvie, "Oil Production Rehabilitation, Fiscal Policy and Economic Development in Libya: A Future View," Energy Economics Letters 2, no. 1 (2015): , doi:10.18488/journal.82/2015.2.1/82.1.1.23.

[36] Jill Junnola, "Italy's Eni Agrees to Tougher Contract Terms to Work in Libya.)," The Oil Daily, June 13, 2008, , accessed 2016, http://www.highbeam.com/doc/1G1-180665879.html?refid=easy_hf.

[37] "Repsol," Annual Reports, Foundations, Social Responsibility and Corporate Information at Repsol.com, accessed October 08, 2016, https://www.repsol.com/es_en/corporacion/conocer-repsol/repsol-en-el-mundo/libia.aspx.

[38] William Danvers, Next Steps in Libya, report (Center for American Progress, 2016), , July 2016, accessed October 08, 2016, https://cdn.americanprogress.org/wp-content/uploads/2016/07/26074652/2LibyaStabilization-report.pdf.

[39] Issa Ali and Charles Harvie, "Oil Production Rehabilitation, Fiscal Policy and Economic Development in Libya: A Future View," Energy Economics Letters 2, no. 1 (2015): , doi:10.18488/journal.82/2015.2.1/82.1.1.23.

[40] Javier Blas, "BP Joins Total in Writing Off Oil Assets Amid Libya Conflict," Bloomberg, July 28, 2015, , accessed October 08, 2016, http://www.bloomberg.com/news/articles/2015-07-28/bp-joins-total-in-writing-off-oil-assets-amid-fighting-in-libya.

[41] Richard Bridle, Lucy Kitson, and Peter Wooders,Fossil-Fuel Subsidies: A Barrier to Renewable Energy in Five Middle East and North African Countries, report (Winnipeg, MB: International Institute for Sustainable Development, 2014).

[42] Bridle, Fossil-fuel Subsidies.