Unemployed and Restless: A Red, Yellow or Green Light for Fintech in SA?

28/10/2016

Primary Analyst: Shaha Yousafzai

Team Leader: Jake MacDonnell

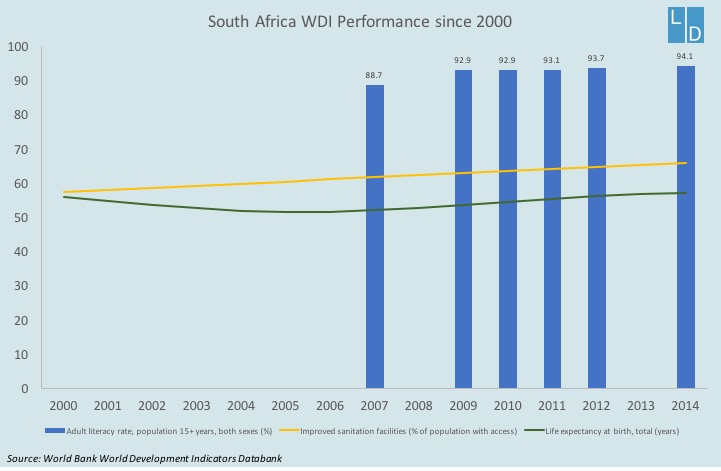

Among the nations of the developing third-world, and especially on the African continent, South Africa is a leader and a force for change in terms of social and political progress. Since its departure from apartheid policies in 1994, the African National Congress (ANC) led by Jacob Zuma has pushed for democratic values of equality in a nation that has been plagued with prejudice and the denigration of the black South African population. Since then, South Africa has introduced equal voting rights, social services such as schools and welfare, and a basic form of public healthcare. In a short period of two decades of democratic governance, South Africa has proven to be a front-runner in the third-world struggle to catch up to developed nations around the world.

On the global scale, however, South Africa has much to accomplish by way of social development. Its unemployment rate is the highest it has been since 2004. In 2016, the unemployment rate was 26.7%, with the biggest job losses in agriculture, transport, and mining. Youth unemployment is even more disappointing, at 52.9%. These figures are mostly due to the larger underpinning problem of high tuition fees in South Africa. In recent months, protests against tuition hikes have become increasingly heated – and sometimes even violent. Students from poorer backgrounds are unable to afford higher education, forcing them to drop out of university and thus preventing them from entering the South African workforce. This is a vanguard issue for South Africa, as 47% of its population is below the age of 24, adding up to more than 25 million people with unfathomable potential. Unemployment is, in turn, a driving factor of high poverty rates and tense race relations, as black South Africans make up the bulk of the unemployed class. To illustrate this discrepancy, the 2011 census found that the average income for a black family is about R60,000, while the average family income for a white family is six times higher at R360,000.

The prevalence of unemployment in South Africa provides an interesting opportunity for those in the financial technology industry. As mentioned, jobs are being lost primarily in labour-intensive fields, such as agriculture and mining. Fintech companies have the chance to capitalize on a changing job market, where disgruntled, young job-seekers are looking to diversify their prospects for employment. Financial technology provides a platform for thousands of new jobs which are not dependent on skills-based training, and are unique alternatives for the traditional financial sector led by the banks of South Africa. Where the youth are looking for alternate forms of employment, financial technology can be the harbinger of a massive shift in the types of jobs they look to. Across the board, startup companies are revolutionizing the various functions of the financial industry: SnapScan has made mobile payments easily accessible consumers and merchants alike, Zoona has made money transfers possible from mobile phones, and Satrix-EasyEquities has allowed average consumers to take part in investing and trading. The opportunities for employment within these companies only grow as the field of financial technology grows.

As student protests become increasingly heated, the government is coming under immense pressure to concede to their grievances. Fintech companies have the leg up amid this conflict in that they are not dependent on the government or the banks in order to operate. By their nature, these companies are entirely separate from the traditional ‘money market’ and are, in fact, looking to disrupt it. So, while the government may have to adjust its spending and budgets to reconcile the students’ appeals, the Fintech sector will remain largely unaffected by these changes. On the other side, if the government chooses to do nothing about the issue, then Fintech still provides a viable alternative for students to seek employment. In sum, Fintech’s detachment from the political and central financial processes allows it to remain safe in the midst of crises within these institutions. Historically, however, South Africa has been able to self-correct itself in times of social unrest. Experts predict that a peaceful resolution to the issue of tuition hikes is not only possible, but probable. For financial technology, this means much of the same – and the same is a steady rise in success.

In addition to its central issue of unemployment, South Africa also has the world’s highest prevalence of HIV/AIDS. The public health sector in South Africa is underfunded and underdeveloped, meaning that healthcare is provided more easily through the private sector. Thus, the rich-poor divide is prevalent with regard to access to adequate healthcare, as a huge portion of the population simply cannot afford it. The government did pass legislation in late 2015 outlining a new healthcare system, called National Health Insurance (NHI) but there haven’t been any tangible effects from those proposals in the short time since they were introduced. There is a general sense of distrust and disappointment with the Zuma government, as it has been marked by political and personal scandal in the recent past. Reports of misspending of state funds, corruption, and familial affairs have caused a great deal of public criticism of the current leadership in South Africa, and even calls for Zuma to step down as President. Crime in South Africa is also on the rise, illustrating the growing ineffectiveness of the South African police forces. The main factor for these high crime rates is the prevalence of poverty and therefore the lack of access to proper education, housing, and overall stability. These social issues require cooperation on the part of the government and the people, as the country moves into a new era of modernity and leadership on the African continent.