Geopolitical Risk for the Energy Sector: South China Sea Dispute

Author: Cynthia Yi

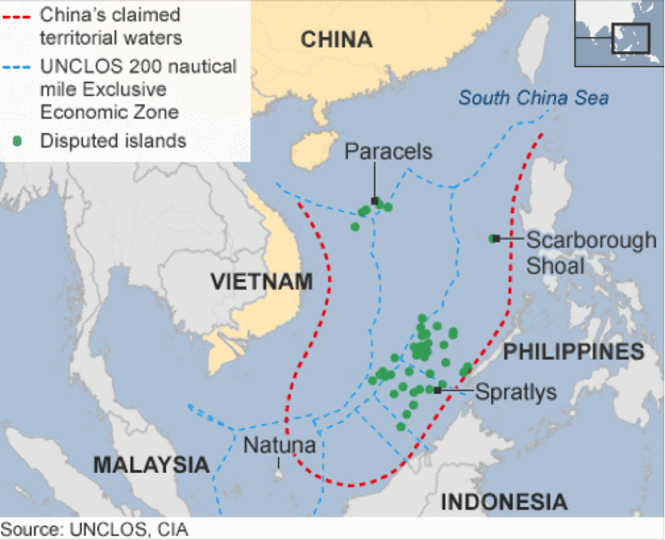

There is increasing uncertainty for the future of Indonesia’s energy sector due to gradual threats imposed by the South China Sea Dispute. Indonesia’s interest in the South China Sea Dispute emerged earlier this year when Indonesia formally protested against China’s ‘nine dash line’; the obscure boundary drawn out by China in 1947 to assert territorial claims to almost 90 percent of the South China Sea. This issue was raised after conflict arose, back in March, between Indonesia and China when a Chinese trawler was caught that fishing inside Indonesia’s Exclusive Economic Zone (EEZ). This act violated Article 57 of the United Nations Convention on the Law of the Sea (UNCLOS), where it states that the country has complete jurisdiction of resources and activities up of the sea up to 200 nautical miles (nm) from the outermost mainland border. This continuous rising tension between Indonesia and China over the South China Sea disputes are further demonstrated by Indonesia’s recent expansion of military presence, and large-scale air force exercises in the Natuna Islands.

Indonesia is a non-claimant state of the South China Sea and has avoided any involvement in the dispute of territorial rights and sovereignty over the South China Sea. However, it does actively partake in efforts to support other claimant countries to prevent China from gaining victory in the South China Sea dispute. Essentially, the South China Sea dispute is conflict over which countries surrounding the Sea get maritime claims to the abundant resources. With China as a powerful actor in the dispute, both claimant and non-claimant states fear that by China claiming more territory in addition to the nine-dash line will affect their economic exports and imports since the South China Sea is the primary, major trade channel in the Asia-Pacific region.

The main issue for Indonesia, regarding China’s nine-dash line, is that the line extends over the UNCLOS Exclusive Economic Zone EEZ which is 200nm off the Natuna Islands of Indonesia. This is concerning as it poses a threat to the sovereignty that Indonesia has over the Natuna Islands and the resources in that area. The Natuna Islands (Kepulauan Natuna) are rich in fish and gas resources, containing one of the largest gas reserves in the D-alpha (East Natuna) block. This field is predicted to contain 46 trillion cubic feet (tcf) of recoverable gas reserves, most of which has not been developed yet. This block displays a very attractive outlook of the energy sector to future investors by providing access to the copious resources and being able to expand the company capabilities through many opportunities in energy development. Thus, if China tries to gain control over this there will be a period of instability where investors may not be able to access the fields. This as a result would also negatively impact the rest of Indonesia’s energy sector making it less suitable for investment.

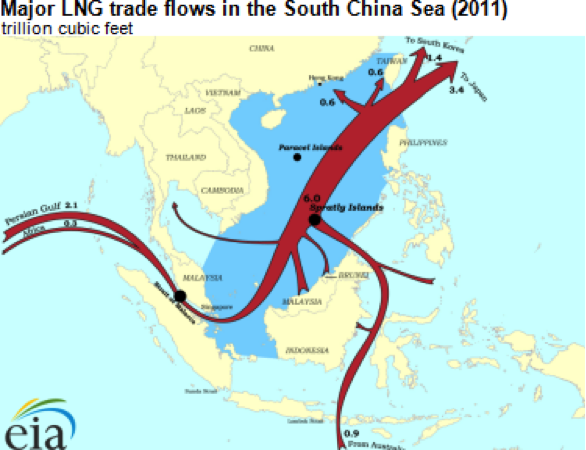

Two potential outcomes if the South China Sea Dispute continues to escalate are the obstruction to the development of gas reserves due to conflict over the control and/ or ownership rights over energy resources. For investors this would mean slowing of energy production which damages the efficiency of the company leading to loss of profits as well. The second consequence of the growing dispute is the obstruction of the sea lanes used for transportation of energy. This could be detrimental to the energy sector because the South China Sea is a crucial energy trade route and is where more than half of global liquefied natural gas is exported and imported. This is significant because Indonesia is the world’s seventh largest exporter of Liquefied Natural Gas (LNG). Implications of this is the increased challenges for foreign investors to export their gas production if these trade routes are affected.

Investing in Natuna sea blocks is still lucrative with the vast amount of untapped recoverable energy reserves. Therefore, companies should not necessarily be deterred from entering the energy sector as there are methods to manage and prepare for these aforementioned risks. Tactics for investors to manage these risks include forming relationships with the World Bank or International Finance Cooperation (IFC); seeing as they are international organizations that provide aid to ensure global markets remain functioning in times of crisis. Another option, although it is costlier, is to acquire political-risk insurance from the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA). This would be beneficial in the case of government losing sovereignty of resources surrounding Natuna, to lessen the losses that the company would suffer by being compensated. Companies should also familiarize themselves with standards and policies that are set by energy regulatory bodies such as SSK Migas, the Special Task Force for Upstream Oil and Gas Business Activities. This would ease resolutions if there’s dispute with the state if the laws change to adapt to the repercussions of the dispute.