Future Areas for Investment in Singapore

Primary Contributor: Haley Daniel

Team Leader: Duncan Spilsbury

7/11/016

The Singaporean economy is one of the fastest growing in the world, and there is an abundance of new investment opportunities to help with the nations growth. The nation has committed to medical research being one of the main sectors, employing many Singaporean people and bringing in new sources of income.

Future Areas For Investment

In recent years, there has been an increasing amount of large pharmaceutical companies moving out of Singapore. Novartis (a swiss pharmaceutical giant), GlaxoSmithKline, Pfizer and Eli Lily are just a few of the main ones who have left the country. This pattern has not only been seen in Singapore, it has been occurring globally as pharmaceutical research is no longer what it once was, it has been restructured all throughout the world.

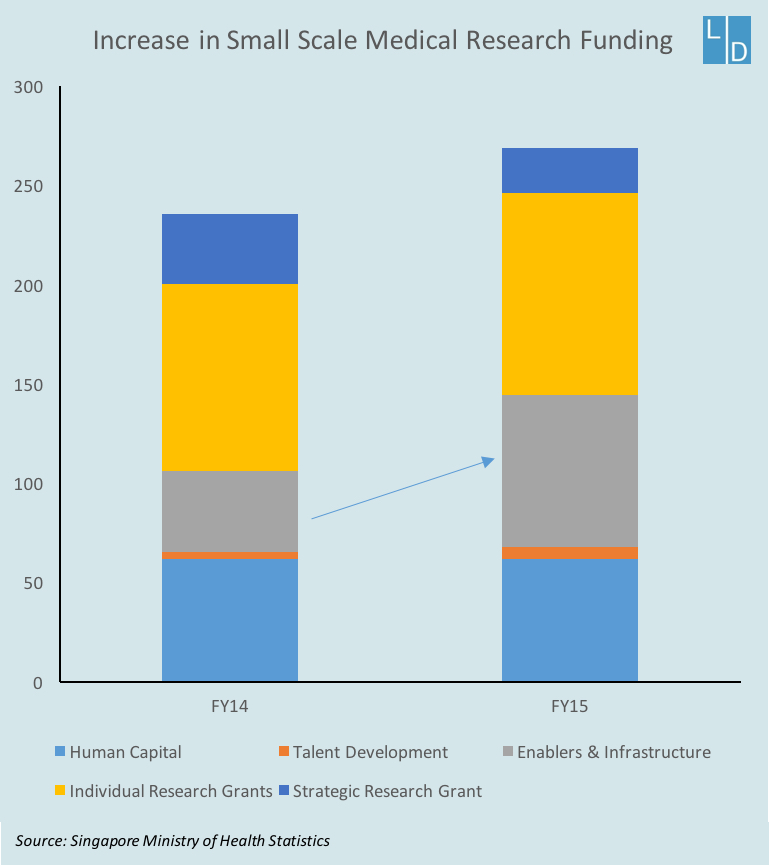

This means that many new products are coming from small biotechnology firms which tend to do especially well in states with deep roots in research, like that of Singapore. Medical device production may be prosperous in Singapore because they are easier to develop, have a higher probability of success and commercialize faster. As markets change, Singapore has to adjust with them to ensure continual growth. Thus, a switch in focus from pharmaceuticals to medical devices may be the most successful route.

Political Risks

Growth is expected to persist into 2016-2018. However, the ongoing slowdown and rebalancing process in China makes it a risk to all of the other South East Asian countries, but in the long term this rebalancing will also produce opportunities for the other economies. There has been a slump in regional trade and a slowdown in China which has hurt many Asian countries as they are the biggest consumers of exports. Singapore has by far been the most heavily impacted. However, the main industries that have been effected are shipbuilding and electronics, there have not been any major losses in the medical research sector.

Furthermore, the nation’s economy is only predicted to grow around 1.9% this year which is a drop from the 2.0% growth in 2015. However, 2017 is supposed to see a 2.5% growth in GDP so there is definitely economic improvement to be seen in the future.

Other potential risks include the threat of terrorism, possible snap elections in Japan and regional maritime disputes. However, these are manageable risks and should not have too profound of an effect on the Singaporean economy.

Conclusion

Singapore, in its commitment to medical research serves as an ideal location for greater investment in medical device production, especially from smaller biotechnology firms. As large pharmaceutical companies move out, there is opportunity for growth in other sectors of biotechnology, like medical devices. The greatest political risk seems to be slowdown of the Chinese economy. Fortunately, the medical research sector does not seem to be affected. Additionally, the Singaporean economy is predicted to continue to grow into 2017. Thus, it could be concluded that it would be beneficial to invest in the production of medical devices in Singapore.