China’s Pharmacy Industry: A tribute to rising health care concerns?

Primary Article Contributors: Liam Scanlon and Allyson Fox

Team Leader: Marissa Vaillant

Keywords: China, Pharmaceuticals, Cost, Expenditure, Demographics, Aging Population

One of the fastest growing markets in China’s expansive economy is the pharmaceutical industry, which deals with the preparation, sale, and use of medicinal drugs. The pharmaceutical market in China is forecasted to expand to $167 billion by 2020 from its current estimated value of $108 billion. Much of this growth will be fueled by the Chinese government’s push to make products more affordable for domestic consumers and increased exports. A significant amount of the market share is made up of domestic pharma companies, while multinational corporations (MNCs) such as Pfizer, AstraZeneca, GlaxoSmithKline (GSK), and Merck & Co., are also prevalent. In some cases, the MNCs will use domestic companies as a “puppet” enterprise to gain an advantage by sidestepping market regulation and related laws. Corruption is also persistent in the nation’s industry as many state and non-state agencies report various cases of pharma corporations producing and selling counterfeit products. The Chinese government has responded by attempting to reform the market using revised strategies and policies.

The People’s Republic of China is a unitary socialist republic, governed by the leader of the Communist Party of China (CPC), President Xi Jinping. In 1949, the CPC seized power of the now single-party system and has remained in power since then. Within the republic, there is a fundamental emphasis placed on centralized planning, a tactic used to control and direct industries within the state by the government. With the ongoing expansion of the pharmaceutical market, the CPC has acknowledged the importance of market supervision. Beginning in the 1980s, a set of structural reforms have been deployed with the intent of improving production and manufacturing efficiencies, fortifying safety standards, and making health care provision and pharmaceutical sales mutually exclusive.

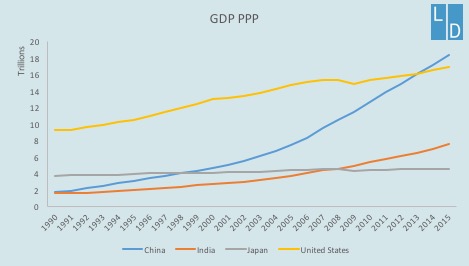

Reformatory political actions from Chinese central planners have inevitable effects on the market. The domestic economy of China has expanded throughout the 20th and 21st century, and it now ranks as the world’s leading exporter of goods and has the largest economy when measured in terms of purchasing power parity (though its nominal GDP remains below that of the United States). However, China’s rising labour and land prices has diminished China’s historic competitive advantage, resulting in decreased demand for Chinese exports. Fortunately for the pharmaceutical industry, the export market is not critical as China’s domestic market is attractive, based on its large population and need for adequate healthcare. Moreover, pharma spending by the government has increased by 8.5% from 2010-2015, indicating the large demand for pharmaceuticals in China and the potential for the market to continue growing. The catalysts of market development include the rising awareness for health care needs and overall economic growth, correlating with the ongoing urbanization and modernization of China.

Although many parts of China have modernized and developed, there remain significant populations who have not benefited from this growth. These people, namely the rural poor, benefited from the government implemented “floating” pharmaceutical price celling created in 2000. This program enabled poorer and rural demographics to access the pharmaceutical market at a more affordable price. However, the program has largely been eliminated and pricing is now kept at reasonable levels by increased competition.

China’s society faces many concerns including an aging population. China’s population in 2015 was 1.371 billion people, with 9.55% of Chinese citizens at age 65 and older. The number of people in the senior demographic is expected to continue growing, and due to the effects of the “One Child Policy” (which resulted in an inverted demographic pyramid) it will comprise a significant percentage of the overall population. People require more health care services as they age, with those aged 65+ making up for 23% to 40% of the prescription drug market and 40% to 50% of the over-the-counter (OTC) market.

While the overall situation indicates that China’s pharmaceutical industry will continue to grow, various factors—including government reform—can impact the speed and consistency of this growth. Over the coming months, subsequent articles will delve deeper into the different sectors that impact this industry and research will be undertaken to determine how companies can best navigate this every changing industry.