The Big Four’s Response to Fintech: Passive, Active, and Hybrid

Primary Article Contributor: Victor Chan

Team Leader: Jake MacDonnell

11/01/2017

As the Fintech industry in South Africa grows, its disruption of the banking sector has forced banks to innovate or risk revenues decreases as customers adopt new offerings. This growth has been notable as South African Fintech companies have received 53.2 percent of total African Fintech investment. In response, banks have realized the future potential of this industry and increased their own investments in innovation. Some banks have embraced the disruption caused by the Fintech sector and worked towards assimilating Fintech companies into their own operations while others have opted towards developing their own technology. Those who do not invest into Fintech risk losing out on future growth and a competitive advantage from securing exclusive revenue streams. There are three main ways to invest in Fintech: passive, active, and hybrid. Each method has their own effectiveness in generating growth for the company. To evaluate the banking sectors reaction towards the Fintech industry, a focus will be drawn towards the different methods of investment of the main ‘big four’ banks consisting of Standard Bank, First RandBank, Nedbank, and Barclays Africa Group Limited.

Standard Bank has already taken a step towards innovation with their transition towards digital interaction, with 95% of their transactions occurring online. In November, Standard announced its willingness to invest ZAR500,000 ($34,757 USD) in the Fintech entrepreneur that wins their Pathfinders Challenge competition. As quite a few banks have, Standard has started to see innovation as a currency that can provide an alternative revenue stream. Additionally, Firepay has also been predominantly acquired by Standard Bank for their QR code-based payment service. Standard Bank has taken a more passive approach as they themselves are not developing the technology. Instead they are relying on external input as a source of disruption.

Similarly, Nedbank has opted to back a Fintech company, Volante Technologies, to revamp their system of validating and processing payments. This was a move to combat the regulation change that occurs in September 2016, requiring South African banks to cease non-authenticated early debit orders. Similar to Standard Bank, Nedbank has partnered up with LaunchLab to create an innovation challenge that provides an opportunity for Fintech entrepreneurs to showcase their ideas and an opportunity for Nedbank to acquire potential disruptors. Nedbank focuses upon a model of competition to attract and acquire original innovative Fintech strategies, which is the same method that Standard Bank has taken up.

First National Bank (FNB) under FirstRand Bank has taken a more active form of innovation. Paving the way for Fintech introduction in South Africa despite being one of the oldest banks, the FNB banking app has gained recognition for making features more accessible to the public. Furthermore, FNB has also been honoured as the Most Innovative Bank in Africa at the 2016 African Fintech awards for their banking app that offers features such as fingerprint verification, secure chat, and tap and pay. They furthered this innovation through the introduction of their own smartphone, ConeXis X1 and Conexis A1. With a focus on innovation that stemmed from 2004 and has grown to over 9000 implemented innovations, FNB has played a more active role in developing their own innovative technology that combats the pressures of the Fintech sector.

ABSA which is a subsidiary of Barclays Africa Group Limited has also innovated in a different direction from the rest as they directed their investment towards Chatbanking that piggybacks on the Twitter and Facebook platform. Not only has ABSA developed their own but have also teamed up with walletdoc, a Fintech company that has made bill payments easier. Unlike the other banks that have been either passive or active, ABSA has taken up a hybrid model that incorporates their own development of innovative technology while still acquiring external Fintech companies to retain a competitive edge against the other banks.

Realizing the future financial risks of being technologically left behind, all 4 banks have noticed the value of Fintech and have invested resources into it, albeit not in the same innovative direction, in response to the rapidly growing Fintech industry. They have used three strategies to achieve the goal of creating reliable alternative revenue streams to resist external disruptions. First, a passive approach relies on external sources of innovative technology such as a Fintech startup or company with existing expertise in the field. An active approach occurs when the bank allocates resources to develop their own technology internally. Lastly, a hybrid model combines elements of both passive and active innovation. Banks have gone beyond their traditional methods to adapt themselves to the changing financial environment through the search for rapid innovation.

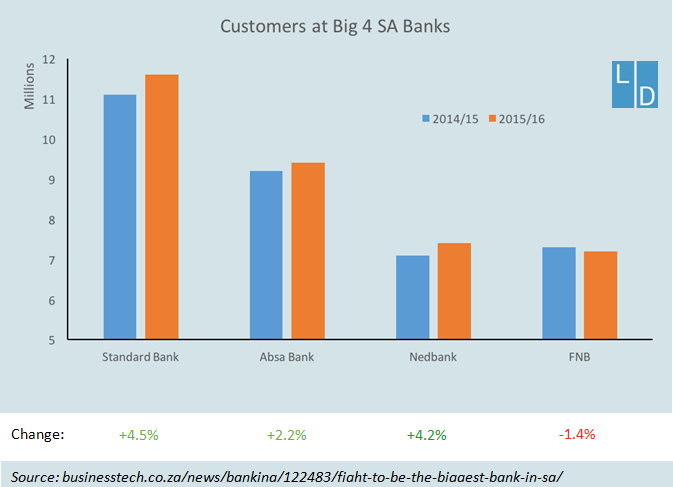

These patterns of growth in association with methods used may provide an insight towards the future of the relationship between banks and Fintech. Clear differences can be seen in the methods of innovation and customer growth from the graph. Although there are many ways to evaluate the future success of a new idea, an increase in customers signals market adoption of the idea itself. After acquiring new customers, the bank can then offer different services to better meet their needs. The passive approach seems to be most effective as it has provided the largest growth to both Nedbank and Standard Bank of around 4%. Opposing, FNB has pursued a more active approach, resulting in a customer loss of 1.4%. ABSA’s growth is in between the two with an increase of 2.2% from the hybrid approach. For South African FinTech, the passive approach currently appears to be the most effective method to invest in as it has the greatest potential in accelerating growth of the customer base. In general, external disruption is quicker than internal innovation, but more expensive. Therefore, although the passive approach is yielding dividends currently, in the long-term the active approach taken by FNB might yield larger gains as their investments are implemented. Depending on bank’s needs, different strategies can be chosen appropriately, ideally balanced between short and long term gain.