Introduction to Energy in Iran

Team Leader: Ashley Audette

Primary Article Contributors: Ashley Audette, Arman Bachmann and Kyle Jacobs

Keywords: Iran, Energy, Oil, Gas, Economy.

October 10, 2016

The economy of Iran is that of a mixed-type economy; private enterprise exists alongside government subsidies and direct marketplace intervention. In 2009 approximately 60% of the economy was centrally planned, but this has fallen in years since due to increasing waves of privatization. The largest sector of their economy is resource development, particularly oil and gas. Iran has 10% of the world's proven oil reserves (the second-largest on earth) and 15% of the world's proven natural gas reserves (4th largest on earth), making them a major player in terms of the global energy marketplace. Despite this crucial role, Western sanctions against Iran from 2006 to January of 2016 (due to their attempt at developing a nuclear weapons program) shut them out of a large portion of the this global market and forced the Iranian government to partially subsidize the oil industry. The near crisis brought on by the numerous sanctions were diverted thankfully due to the deal reached between the Iranian government and the Obama administration in January of 2016, which lifted sanctions and allowed for a return to the global marketplace for Iran.

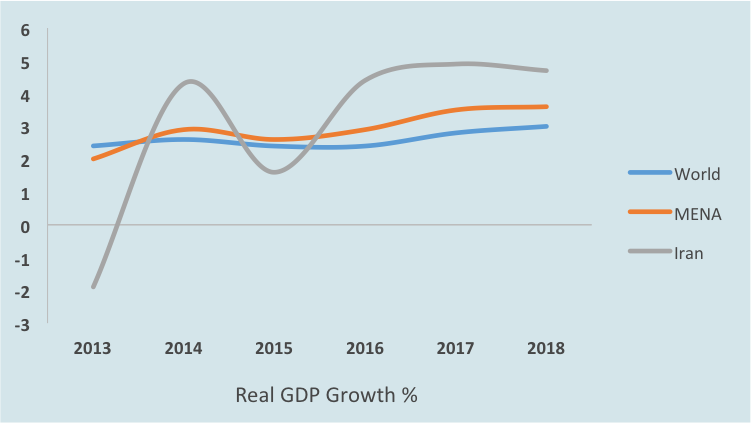

Sanctions and subsidaries aside, the Iranian GDP makes it one of two regional powers in the Middle East-North Africa (MENA) region (the other being Saudi Arabia). Their GDP in 2015 was $393.7 billion USD, putting them 18th in the world overall (between Canada and Australia, as an example). GDP grew 0.5% in 2014 but the upcoming Iranian government plan for the 2016-2021 period hopes to grow by 8% per year after instituting economic reforms, particularly the subsidy program that cost the state $77.2 billion USD in the 2007-2008 period, or approximately 27% of the Iranian GDP. A combination of increased foreign investment and the return of global Iranian assets that were frozen both in 1979 and 2005 are expected to increase the purchasing power of the Iranian currency, the Rial, which will help to drive down the inflation rate (pegged at 10.2% in 2016).

The importance of the Iranian natural gas and oil industries not only to the Iranian economy, but to the global market, is undeniable. Following the signing and implementation of the Joint Comprehensive Plan of Action, which limited the Iranian nuclear program in exchange for the lifting of sanctions against Iranian and the unfreezing of Iranian assets, has since led the way for the emergence of new opportunities for foreign investors in the Iranian economy; particularly Iran’s vast oil and natural gas reserves. After Russia, Iran controls on the world’s second largest amount of natural gas reservoirs. The lifting of the sanctions quickly changed the outlook of FDI in Iran - in the first quarter of 2016 Iran was in the top three destinations for FDI in the Middle East, a significant jump from its twelfth place rank from 2003-2015.

Recently, the Iranian President Rouhani’s government unveiled its Sixth Development Plan (2017-2022). Montazer Torbati, the CEO of Iran Gas Engineering and Development Company, believes that the plan will require “5000 kilometres of pipelines as well as 25 pressure boost stations.” Such massive infrastructure requirements opens up significant opportunities for foreign companies to invest and participate in Iran’s growing energy industry. According to Torbati, Iran cannot raise the financial capital required to reach these lofty goals and thus requires foreign direct investment. Iran’s Deputy Petroleum Minister, Masoud Hasemian Esfahani has said that Iran’s oil and gas industry will require $185 billion in investments for 2016-2020. European companies, such as BP, Eni, Repsol, Shell, Statoil, and Total, have quickly began discussions with Iranian officials and are keenly interested in investing in the future grown of Iran’s natural gas industry.

Not only are European companies interested in Iran’s natural gas sector, but Asian countries have long been loyal customers of Iranian energy products. Currently, India is considering investing up to $20 billion in Iran’s energy industry, with Indian companies focusing on building petrochemical plants, gas-processing facilities, and an expanded port at the Iranian city of Chabahar. In April, China reached an agreement with Pakistan to construct a pipeline from Gwadar port in Pakistan to the northern town of Navvabshahr, near the Chinese border. Iran hopes to connect its Peace Pipeline to Gwadar in order to more easily export to China. China’s natural gas consumption is expected to grow 4.7% every year, and Iran hopes to capitalize on that growing market. However, Iran will require significant amounts of foreign direct investment in order to build the infrastructure required for both natural gas extraction and transportation.

Overall, the Iranian economy is one of cautious hope. While high unemployment, low global oil prices, and inflation continue to hamper the economy, increased production and consumption as well as thawing relations with Western countries and a more normalized role in global markets are key indicators that it will continue to be a growth economy for the foreseeable future.