Singapore Government’s Role in Biomedical Science

Primary Contributing Analyst: Ed Tse

Team Leader: Duncan Spilsbury

Singapore’s rapid rise as one of Asia’s richest countries can be attributed to the government’s focus on maintaining political legitimacy through economic development. To facilitate and maintain economic development, the People’s Action Party (PAP), the ruling party since 1959, setup various governmental institutions to build an environment and infrastructure that is conducive to businesses.

There are three government associated institutions that are key to the BMS in Singapore: the Economic Development Board (EDB), the National Research Foundation (NRF), and the Agency for Science Technology and Research (A*STAR).

|

|

EDB |

A*STAR |

NRF |

|

Establishment |

1961 |

1991 |

2006 |

|

Government Branch |

Ministry of Trade and Industry |

Ministry of Trade and Industry |

Prime Minister’s Office |

|

Responsibility |

Attract foreign investors |

IP management, facilitate international collaboration, research funding |

Develop policies, plans, and strategies for R&D |

|

Bioscience unit |

Strategic Business Unit for Biotechnology |

Biomedical Research Council |

Health & Biomedical Science Directorate |

Government Report Card

What are the results of such heavy government involvement in the development of the bioscience sector?

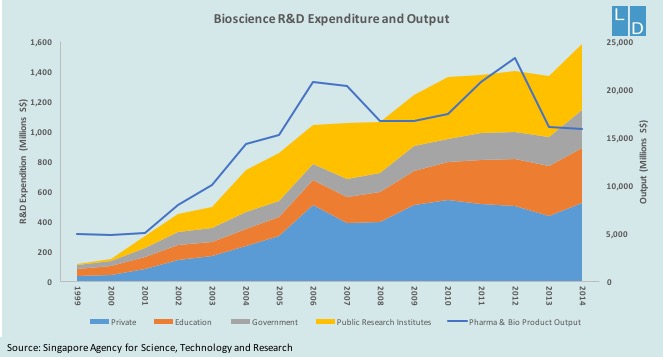

In 2015, pharma & bio product output accounted for roughly 3.7% of GDP. Note that one cannot read too direct a relationship between R&D expenditure and pharma & bio product output. R&D can develop valuable IP and startups that are not included in product output statistics.

The general trend in the BMS is reflected in Singapore. Private R&D has stagnated. Big pharma has cut back on R&D centres due to the reliance on outsourcing and M&A. Eli Lily, Pfizer, and GlaxoSmithKline closed their R&D centres in Singapore in 2010, 2013, and 2014, respectively. Most of the cutting edge work in the biosciences is now conducted by startups and university labs. The decrease in private R&D cannot be attributed to any glaring mistakes made by the government.

Pharma & bio product output is significantly below the peak of 2012. Pharmaceutical production is inherently unstable largely due to the timing of the drug production cycle. Medical devices output has had very consistent growth (2013-12%, 2014-9.5%, 2015-33%). The faster development, more certain revenue, and lower regulation of medical devices is drawing increasing government investment.

Risks

One of the biggest hurdles for Singapore’s growth is the small population. Despite government investment in the biomedical science (BMS) sector, China is continuing to draw investment due to its lower costs, bigger market, and larger scientific knowledge base. Singapore still has an edge in ethics, reliable IP protection, and lower government risk.

The move away from big pharma R&D to start ups for innovation is also troubling, but Singapore’s startup community is much livelier than a decade ago. A*STAR and many other BMS institutes have invested heavily in innovative infrastructure such as Biopolis, a BMS R&D hub. The hope is that these innovation breeding grounds will lead to more BMS startups.

Domestic political risk is low. The PAP has been accused of gerrymandering and suppressing opposition[1]. In the 2015 general election, the PAP received 69.86% of the votes and took 83 of the 89 seats in Parliament. In the unlikely scenario that the PAP is defeated, it is unlikely that the opposition would change the economic policies which have brought great wealth.

Singapore is relatively neutral in regional struggles and therefore would unlikely be drawn into such conflicts. North Korea is a threat to almost everyone but its most immediate impact would be China and South Korea, who are both big regional players in BMS. Singapore would be a good Asian country to hedge the risk of North Korea.

Conclusion

Singapore is well placed to take advantage of the focus on startups in the BMS sector. Traditional pharma and bio product manufacturing is resilient but will face increasing competition from China which will likely slow down future growth.

Domestic political risk is low, especially for the BMS sector which is providing high paying jobs for Singaporeans. Regional risk is low but North Korea is a wild card.